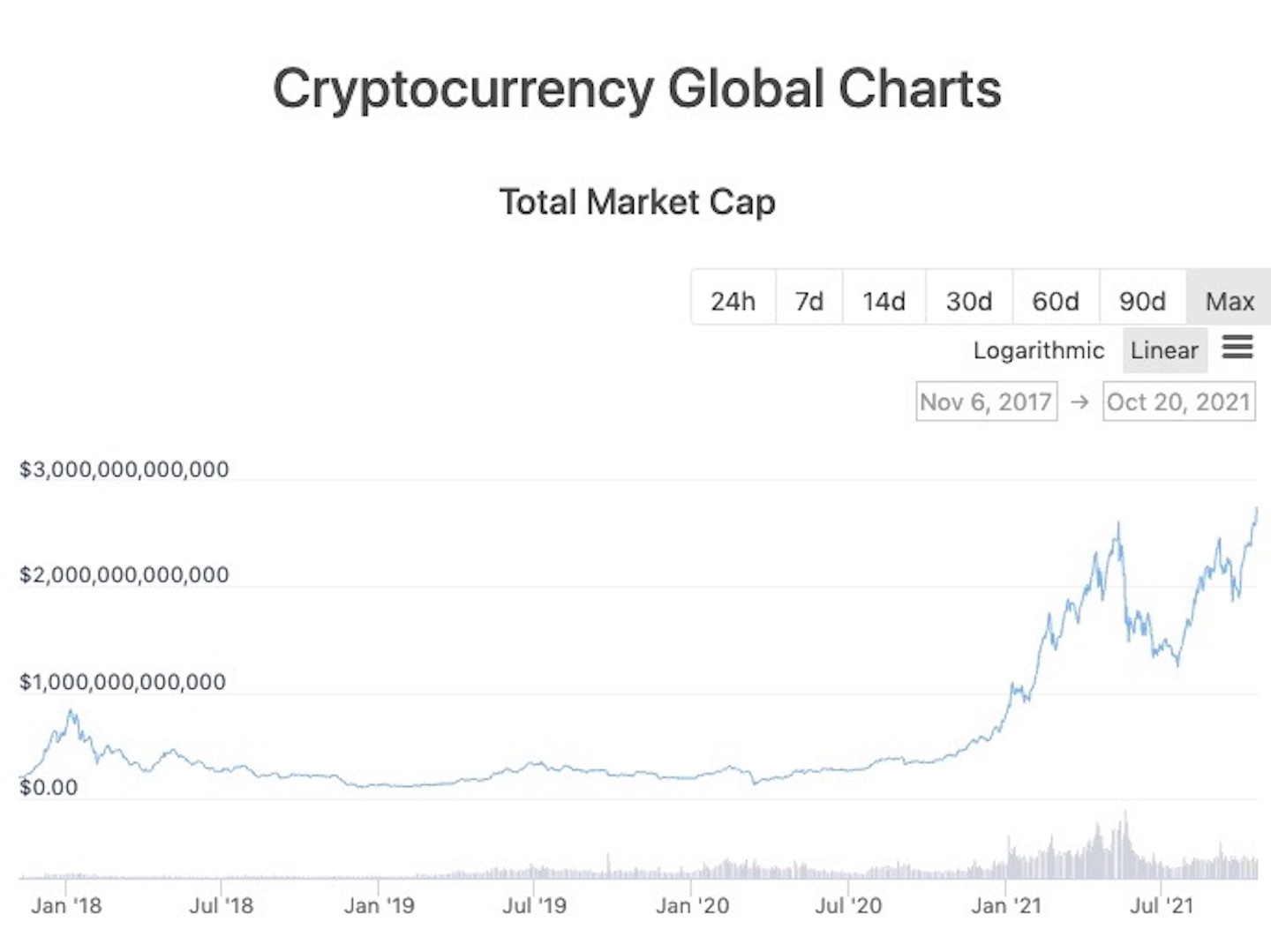

- Market cap of all cryptocurrencies

- Are all cryptocurrencies mined

- Are all cryptocurrencies based on blockchain

What is the market cap of all cryptocurrencies

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify https://iconicint.com/slots/freeslots/. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.

Market cap of all cryptocurrencies

We calculate a cryptocurrency’s market cap by taking the cryptocurrency’s price per unit and multiplying it with the cryptocurrency’s circulating supply. The formula is simple: Market Cap = Price * Circulating Supply. Circulating supply refers to the amount of units of a cryptocurrency that currently exist and can be transacted with.

We calculate a cryptocurrency’s market cap by taking the cryptocurrency’s price per unit and multiplying it with the cryptocurrency’s circulating supply. The formula is simple: Market Cap = Price * Circulating Supply. Circulating supply refers to the amount of units of a cryptocurrency that currently exist and can be transacted with.

In order to send and receive a cryptocurrency, you need a cryptocurrency wallet. A cryptocurrency wallet is software that manages private and public keys. In the case of Bitcoin, as long as you control the private key necessary to transact with your BTC, you can send your BTC to anyone in the world for any reason.

A cryptocurrency’s market cap increases when its price per unit increases. Alternatively, an increase in circulating supply can also lead to an increase in market cap. However, an increase in supply also tends to lead to a lower price per unit, and the two cancel each other out to a large extent. In practice, an increase in price per unit is the main way in which a cryptocurrency’s market cap grows.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

Cryptocurrencies such as Bitcoin feature an algorithm that adjusts the mining difficulty depending on how much computing power is being used to mine it. In other words – as more and more people and businesses start mining Bitcoin, mining Bitcoin becomes more difficult and resource-intensive. This feature is implemented so that the Bitcoin block time remains close to its 10 minute target and the supply of BTC follows a predictable curve.

Are all cryptocurrencies mined

As a response, some cryptocurrencies are moving to more energy-efficient consensus algorithms like Proof of Stake (PoS) or hybrid systems. These algorithms do not rely on computational power, and as a result, they are significantly less energy-intensive.

Bitcoin Cash was created as a result of a hard fork from Bitcoin in 2017. It was designed to address Bitcoin’s scalability issues by increasing the block size limit. Bitcoin Cash also uses the SHA-256 algorithm, and mining it is similar to Bitcoin mining.

An important piece of information to keep in mind is that many cryptocurrencies aren’t mined including the second largest in ether. Cryptocurrencies that don’t mine use other mechanisms to secure the network, each with their own set of tradeoffs.

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success.

Are all cryptocurrencies based on blockchain

Blockchain allows for the permanent, immutable, and transparent recording of data and transactions. This, in turn, makes it possible to exchange anything that has value, whether that’s a physical item or something more intangible.

If you have ever spent time in your local Recorder’s Office, you will know that recording property rights is both burdensome and inefficient. Today, a physical deed must be delivered to a government employee at the local recording office, where it is manually entered into the county’s central database and public index. In the case of a property dispute, claims to the property must be reconciled with the public index.

All digital assets, including cryptocurrencies, are based on blockchain technology. Decentralized finance (DeFi) is a group of applications in cryptocurrency or blockchain designed to replace current financial intermediaries with smart contract-based services. Like blockchain, DeFi applications are decentralized, meaning that anyone who has access to an application has control over any changes or additions made to it. This means that users potentially have more direct control over their money.

A motivated group of hackers could leverage blockchain’s algorithm to their advantage by taking control of more than half of the nodes on the network. With this simple majority, the hackers have consensus and thus the power to verify fraudulent transactions.

Most public blockchains arrive at consensus by either a proof-of-work or proof-of-stake system. In a proof-of-work system, the first node, or participant, to verify a new data addition or transaction on the digital ledger receives a certain number of tokens as a reward. To complete the verification process, the participant, or “miner,” must solve a cryptographic question. The first miner who solves the puzzle is awarded the tokens.